LendingClub Fails To Leverage Its "Core" Asset - The Data

LendingClub was the world’s largest peer-to-peer lending platform at its height in 2015. It was able to achieve this amazing feat in less than a decade after launching its full-scale operations in 2007. However, in 2020, LendingClub decided to acquire Radius Bank and terminate its flagship peer-to-peer lending platform. Was this pivot a wise move? Or a hasty one which reflected a lack of appreciation for the “core” asset of the business – its data?

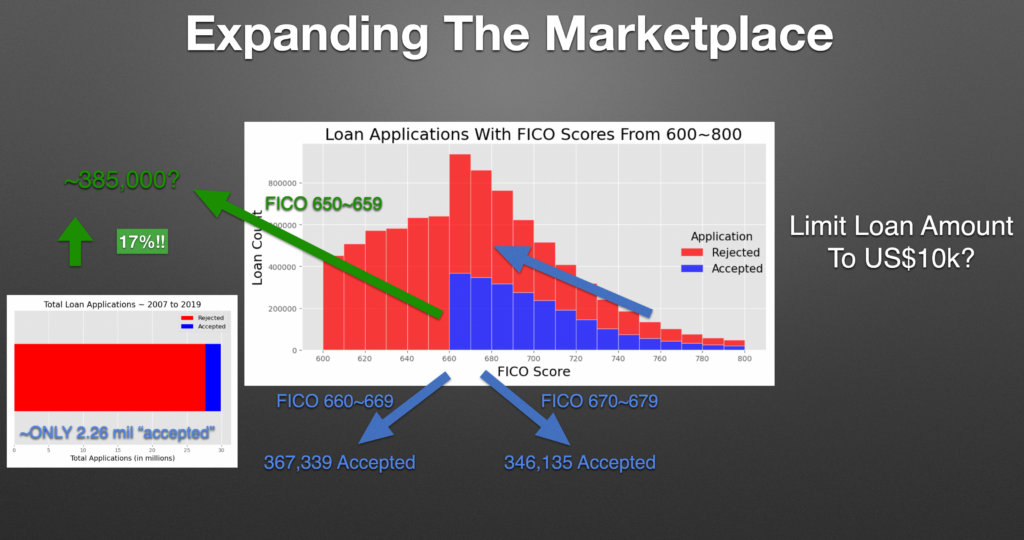

Approximately 1 in every 8 US adults applied for a loan on LendingClub between 2007~2019. Of the 29.9 million loan applications, only 2.26 million (or 7.5%) were approved.

A LightGBM classifier illustrates with 97.5% accuracy that the three most important features for a borrower's application were their FICO Score (86%), Debt-To-Income Ratio (8%), and Length of Employment (6%).

In general, a borrower would require a FICO Score greater than 660, a Debt-To-Income Ratio of less than 40%, and an Employment Length of more than 1 year to be accepted on the LendingClub platform.

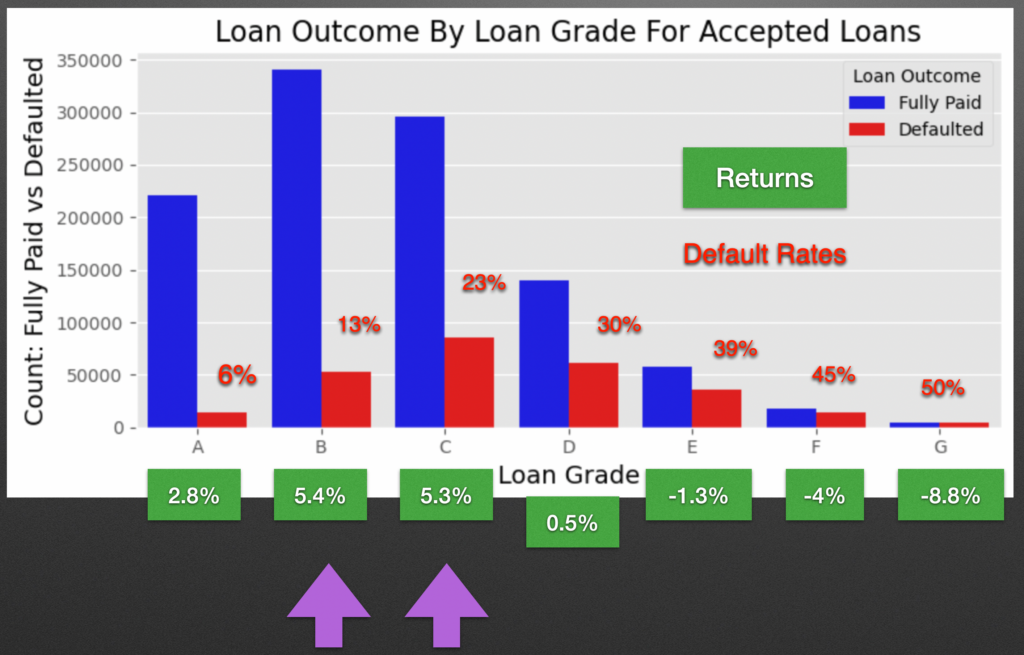

Once the borrower's loan application was accepted by LendingClub, each listing would be assigned a loan grade and an interest rate. Loan grades ranged from A to G with corresponding interest rates that reflected their risk profile.

Investors would get access to all approved loans and information including the loan amount, purpose, grade, term, interest rate, the borrower's FICO score, debt-to-income ratio, and income. After accounting for default rates, a passive investor could earn north of 5% if they invested in loans which were granted a "B" or "C" grade by LendingClub.

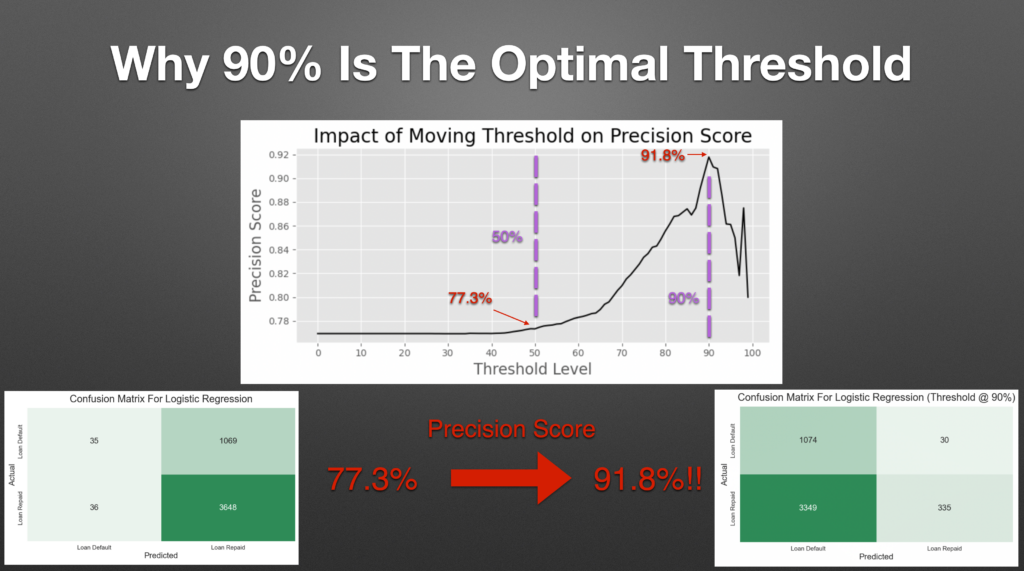

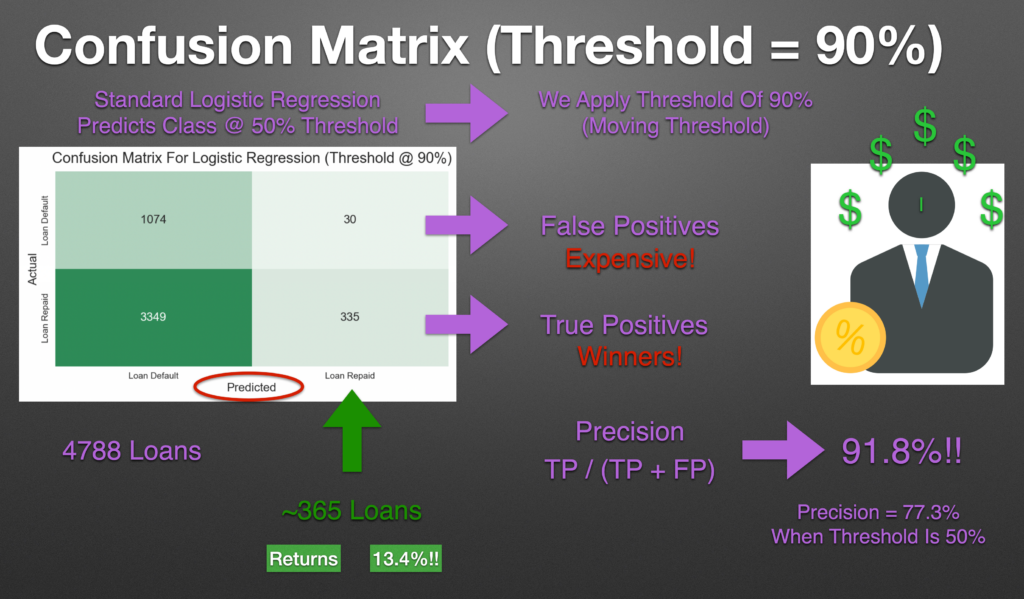

Active investors with a background in data science and machine learning could earn higher rates of return by: (i) filtering for loans with interest rates greater than or equal to 20%, borrowers with loan amounts less than US$9,000 and annual incomes greater than US$60,000, (ii) applying Logistic Regression with an optimal threshold, and (iii) investing in all loans that were predicted by the model to be fully repaid. This simple strategy would yield north of 13% for the investor.

Instead of terminating its P2P lending marketplace, LendingClub should have expanded its reach by lowering the acceptable FICO Score for borrowers. A mere reduction of 10 FICO points would have increased revenue by an estimated 17% as a result of attracting more potential borrowers and investors onto its platform. An additional prudent measure to protect investors would have been to limit loan amounts to a maximum of US$10,000 (instead of US$40,000) for borrowers with FICO Scores below 660.

When LendingClub acquired Radius Bank in 2020, it shifted its business to adhere to a more traditional banking route and terminated its P2P lending marketplace. It seems that it lost sight of the fact that its core asset was its data. If LendingClub had maintained its online presence while expanding its services to new borrowers and investors, it would be “paid” to acquire additional data on consumer loan behavior. This could lay the foundation for “reinventing FICO” and a partnership with data-driven tech such as Apple’s buy now, pay later (BNPL) program.

ARIELLA BROWN

So, why exactly did LendingClub move away from its “new economy” flagship P2P presence towards an “old economy” traditional banking model? What prompted its midlife crisis? While LendingClub did not reveal their reasoning for the shift, it is likely that they opted for this path to lower their cost of funding with a banking license and take on the “credit risk” by investing in the consumer loans themselves.

As startups and early stage fintechs mature they often pivot to enhance their competitive edge. However, not all pivots are successful. Only time will tell whether LendingClub’s most recent pivot pays off. Regardless of the outcome, one thing is clear: LendingClub opted for an “old economy” model, over a “forward looking” data driven approach.

Credits, References & Special Thanks: