Examine "FAANG" stocks from the Nasdaq website. Analyze Short Interest, Institutional Ownership and Insider Trades

The Nasdaq website publishes information on stocks listed on it's exchange. The information includes fundamental categories like "Short Interest" and Holding categories like "Ownership Summary" and "Insider Trades." I have chosen to use Selenium to scrape the Nasdaq website. For this project, I will be examining the "FAANG" stocks listed on the Nasdaq. "FAANG" is a acronym for 5 of the most popular and best performing stocks: Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Google (GOOG). The growth of these high flying tech stocks have made it especially attractive for money managers to add these names in their portfolio's. Mandatory SEC 13-F filings give us a glimpse of who holds these stocks. On the other hand, we will also examine the Short Interest in these stocks, which shows investor sentiment of a stock and expect the shares to fall.

Short Interest

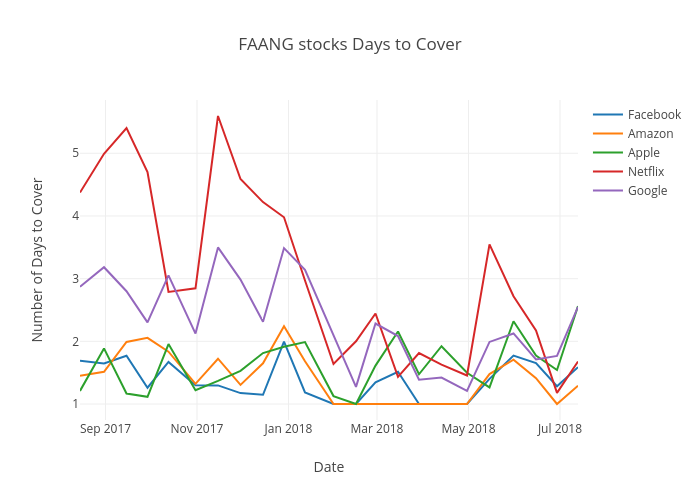

Short Interest is a bearish indicator for a stock made up of the number of shares sold short that have not yet been covered or closed out. It is calculated by looking at the "Days to Cover" (DTC) statistic as a judge for rising or falling sentiment for a stock on a bi-weekly basis. Firms are required to report their short positions as of settlement on the 15th of each month. A compilation is published 8 business days afterward on the NASDAQ website. Days to Cover is calculated as the aggregate short interest for the month divided by the average daily share volume traded between short interest settlement dates. NASDAQ provides a year's data of Short Interest. Scraping the table gives us the line graph below.

We can see that the DTC for each stock and how they've trended in the past year.

- We can see Netflix DTC has come down from over 5 DTC in 4th quarter of 2017 to now under 2 DTC

- Google exhibiting a similar pattern to Netflix, coming down from over 3 DTC to now and has recently spiked again 2.5 DTC

- Apple DTC was in the 1 to 2 day band, now spiking to 2.5 DTC

- Amazon and Facebook DTC in the 1 to 2 day band

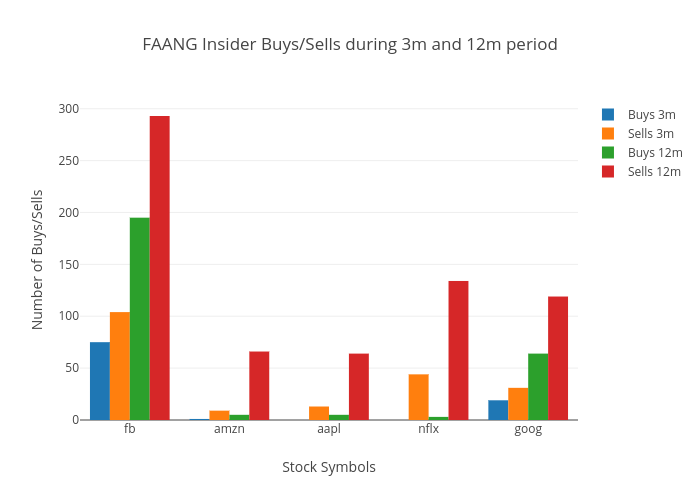

This table shows the number of buys/sells for the past 3 months and number of buys/sells for the past 12 months from insiders. We can see for FB, that the number of sells outweighed the number of sells in both the past 3months and 12months. To get a better picture of the amount of share activity, please refer to the chart below.

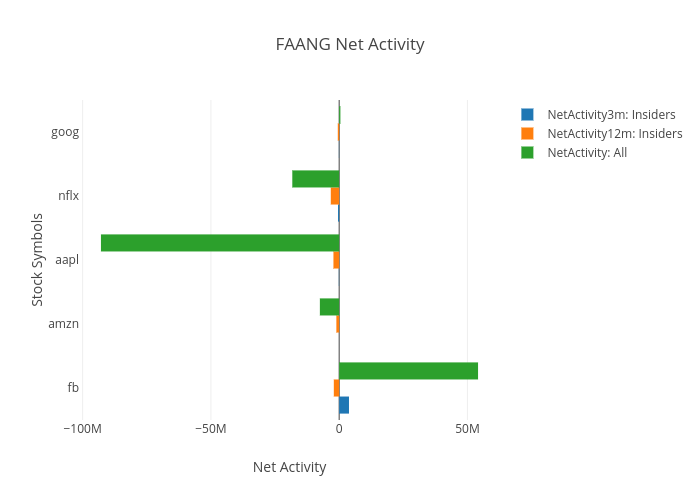

This table shows the net activity in shares. The blue and orange bars show the total amount of shares brought and sold by insiders in the past 3months and 12 months respectively. The green bar shows the total amount of shares brought and sold by Institutional Holders over the past year. Apple stands out from the other stocks in this bar graph as, Institutions have sold over 90m shares of the company over the past year.

Ownership Information

NASDAQ shows ownership information from institutions and the below picture shows the percentage that Institutions hold, the number of holders, the number of shares and the value of the holdings.

We can also see the top five holders and the numbers of shares of each stock listed on the NASDAQ.

Conclusion: Trends in Short Interest, Ownership Activity and Insider Trades can show you more factors to apply to the analysis on your stock. That could help you make better-informed decisions about buying or selling at particular points in time.